During high volatility in Indian share markets, BSE Sensex and Nifty 50 lost 4 per cent this week. Satish R Menon, Executive Director at Geojit Financial Services, believes that the equity market is near the bottom and in the next few months, more volatility is on the cards. In an exclusive interview with Surbhi Jain of Financial Express Online, Menon suggests investors to prepare a quality equity portfolio to generate wealth in the long-term. On the sectoral front, he sees consumption and pharma sectors most stable sectors in the Indian industry and holds a positive view on them. During the …

February 2023

Gwalior Madhya Pradesh Assembly Constituency Election 2023: Date of Result, Voting, Counting; Candidates

As anticipation mounts for the upcoming Gwalior Constituency Election in Madhya Pradesh, voters are eagerly awaiting the big battle that kicks off with the announcement of key dates by the Election Commission of India. Here, we provide you with essential details about the Gwalior Constituency Assembly Election 2023 that every voter should be aware of. Gwalior Constituency Madhya Pradesh Assembly Election 2023: Voting Date The voting date for the Gwalior Assembly Constituency Election 2023 has been officially announced by the Election Commission. As per the ECI, Gwalior Assembly Constituency will go to polls on November 17. Stay tuned for updates …

Rupee may hit 81 per US Dollar in near-term on domestic, global concerns; INR fall could push bond yields up

By Dilip Parmar Indian rupee heads for the eighth monthly decline, the first time in the last two decades such kind of selling has been seen amid domestic and global worries. Central banks have unsuccessfully tried defending their currencies against the US Dollar by running down foreign currency holdings. The fight against depreciation has already drained their FX reserves. However, we are still the median performer among Asian peers mainly on the back of RBI intervention and better growth prospectus after the pandemic. For the current calendar year, India’s forex reserves fell from $633.61 billion to $564.05 billion, as per …

Markets likely to trade volatile in near term, ‘buy on dips’; 5 things to know before market opening bell

Indian equity markets are expected to open in the red as trends in the SGX Nifty ahead of Monday’s session hint at a flat to negative start for benchmark NSE Nifty 50 and BSE Sensex. “Indian markets have been showing resilience despite several global headwinds. While markets in the near term may remain volatile in a broader range, we are positive on the mid to long term perspective on the back of healthy domestic macros, strong fundaments, earnings growth and upbeat festive season. Broader market has been outperforming well and is likely to remain in flavour with action in niche …

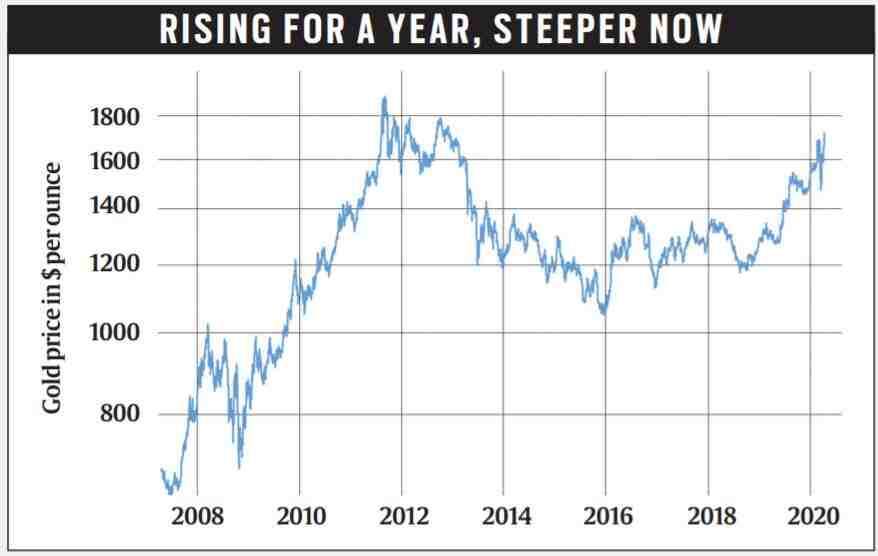

Gold the ‘currency of last resort’: Right time to hike gold allocation; these factors may fuel prices

By Rajesh Cheruvu Crisis periods drive investor sentiments to an extreme risk-off bringing safe-haven assets into focus. Gold is one of the premium stores of value, even at times, better than the reserve currency USD. CY19 saw gold rallying as the US-China trade war led to a weak global economy. This forced central banks to open the liquidity tap which acted as a big booster to gold prices. As India too witnessed an economic slowdown, gold outperformed the risk asset class of Equity in CY19. CY20 started off on a much weaker footing as Covid-19 pandemic disruption has led to …

Share market volatility an opportunity to buy great stocks at cheap price; time to up SIP allocation

Following a volatile September, where BSE Sensex and Nifty 50 lost over 2 per cent, Amar Ambani, Senior President and Head of Research at Yes Securities, believes that volatility gives investors an opportunity to buy good stocks at below fair value. Seeing the current market trends, Ambani sees Nifty 50 is set to cross the previous high of 12,300 in the next four months. As for the investors who already have an ongoing SIP, Ambani advises them to increase their SIP allocation. In an interview with Surbhi Jain of Financial Express Online, Amar Ambani said he expects companies in the …

NSE phone tapping: Delhi court dismisses Chitra Ramkrishna’s bail plea in money laundering case

A Delhi Court on Monday dismissed the bail application of former managing director and chief executive officer of the National Stock Exchange (NSE) Chitra Ramkrishna in a money laundering case related to the alleged illegal phone tapping and snooping of NSE employees. Special Judge Sunena Sharma denied the relief, saying the stage was not set to allow the bail. During the hearing, the ED had opposed the bail plea, saying the investigation was ongoing in the matter and she was “directly or indirectly” indulging in the crime. The ED’s Special Public Prosecutor N K Matta had told the court that …

Nifty may hit 18600 target by Dec-end, charts show support at 16800; Buy Reliance, SBI, HDFC Bank, Airtel

NSE Nifty 50 index may hit a 18,600 target by the December 2022-end on the back of outperformance of BFSI, IT, Auto, Capital goods and PSU stocks, ICICI Direct said in a report. The brokerage firm advised to use dips for buying as strong support is seen at 16800. In the afternoon deals, Nifty 50 was ruling at 17,586.15, up 0.4 per cent. It also noted that Nifty’s breakout above the major trend line signals the end of the corrective phase. It said Nifty is set to touch 18600, as the current rally of 18% is the strongest since October …

Tamilnad Mercantile Bank IPO fully subscribed on Day 2

The initial public offering (IPO) of Tamilnad Mercantile Bank (TMB) was fully subscribed on its second day on Tuesday. The offer received bids for 13.3 million shares, against the IPO size of 8.712 million shares, getting subscribed 1.53 times. Retail investors booked their quota 3.61 times, and non-institutional investors booked 1.27 times their reserved portion. The lender has fixed the price band at Rs 500-525 per share. The offer will conclude on Wednesday. Also read: DreamFolks IPO share allotment: Check status via BSE, Link Intime, grey market premium; stock listing on Sep 6 TMB intends to use the net proceeds …

Dollar touches 20-year high, but kept in check by euro, as rates in focus

The dollar touched a fresh 20-year high on Monday, fuelled by hawkish comments by Federal Reserve Chair Jerome Powell, but was kept in check by the euro, which was supported by growing expectations for European Central Bank (ECB) rate hikes.The dollar index, which measures the currency’s value against a basket of peers, scaled a fresh two-decade peak of 109.48 before retreating. The greenback was up 0.73% against Japan’s yen, while Britain’s pound notched a fresh 2-1/2 year low in thin trading, with the UK on a public holiday. Powell told the Jackson Hole central banking conference in Wyoming on Friday …