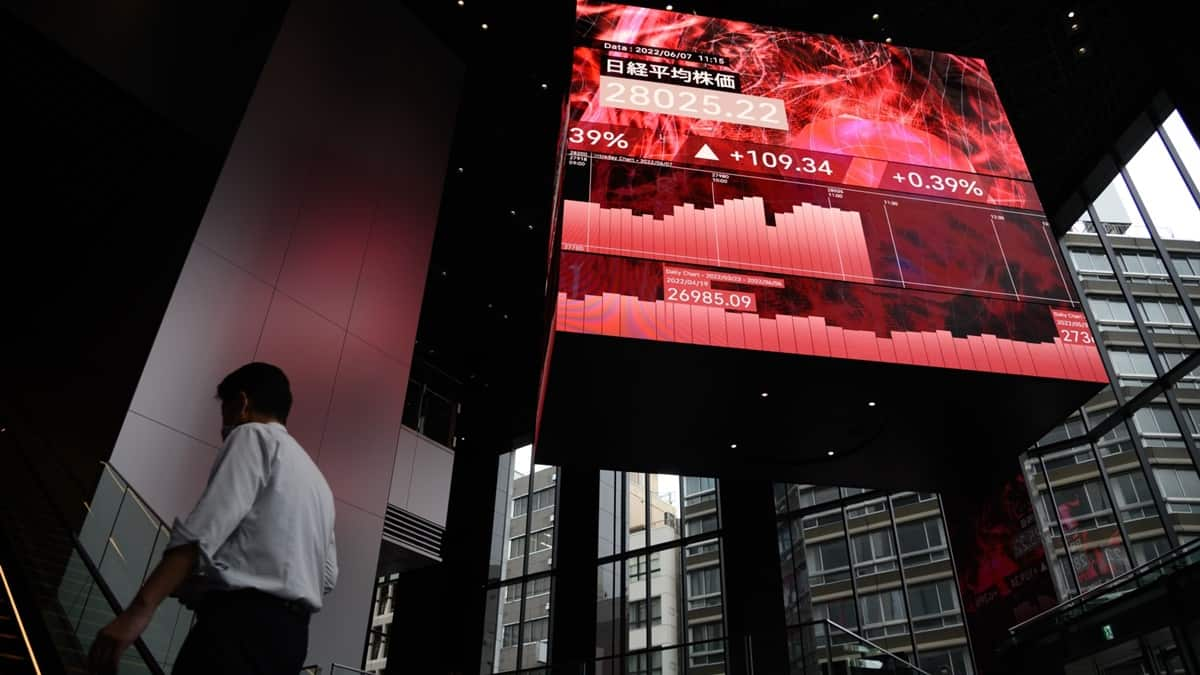

Stocks in Asia fell Wednesday on the prospect of continued aggressive Federal Reserve monetary tightening and as traders assessed a possible uptick in tension between China and Taiwan. Equities slid in Japan, Australia and South Korea. Futures shed more than 2% for Hong Kong, possibly reflecting the risk of mounting friction between Beijing and Taipei after Taiwanese soldiers fired shots to ward off civilian drones. US-listed Chinese equities fell Tuesday amid those developments. Contracts for the S&P 500 and tech-heavy Nasdaq 100 fluctuated after Wall Street shares hit a one-month low.

Robust US labor demand and consumer confidence data added to the case for sharp interest-rate hikes to tackle inflation. Fed officials reiterated their determination to curb price pressures. A dollar gauge and Treasuries were steady, while a deepening yield curve inversion points to fears that the Fed will trigger a recession. Oil headed for a third straight monthly drop — the longest losing run in more than two years — hampered by the likelihood of slower global growth.

Market bets on a shallower trajectory for Fed tightening are receding, raising the prospect of more losses for stocks and bonds in an already difficult year. Investors are scouring incoming data for clues on the policy path, with August US jobs figures on Friday the next key report. “What’s clear is that predicting this market is not clean cut,” Angeline Newman, a managing director at UBS Global Wealth Management, said on Bloomberg Television. “We are living in a world where conflicting economic signals are making the path of monetary policy very difficult to determine.”

Fed officials again stressed their commitment to defeating inflation while remaining vague on how big their policy move will be next month. New York Fed chief John Williams said rates will need to be held in restrictive territory for “some time,” adding that this meant through 2023 — the latest official to push back on financial-market expectations of cuts later next year. Investors are also contending with a European energy crisis that threatens to drive the region into recession as well as China’s property slump and Covid curbs. Bloomberg Economics expects purchasing managers’ indexes to signal manufacturing contraction in China.

Here are some key events to watch this week

ECB Governing Council members due to speak at event Tuesday through Sept. 2China PMI, WednesdayEuro-area CPI, WednesdayRussia’s Gazprom set to halt Nord Stream pipeline gas flows for three days of maintenance, WednesdayCleveland Fed President Loretta Mester due to speak, WednesdayChina Caixin manufacturing PMI, ThursdayUS nonfarm payrolls, FridayUK leadership ballot closes Friday. Winner announced Sept. 5

Some of the main moves in markets

StocksS&P 500 futures rose 0.1% as of 9:21 a.m. in Tokyo. The S&P 500 fell 1.1%Nasdaq 100 futures added 0.2%. The Nasdaq 100 fell 1.1%Japan’s Topix index fell 0.7%Australia’s S&P/ASX 200 index dropped 0.8%South Korea’s Kospi index lost 0.9%Hang Seng Index futures slid 2.3% earlier

Also Read: Stock market holidays in August: BSE, NSE to remain shut today on Ganesh Chaturthi, currency trading closed

CurrenciesThe Bloomberg Dollar Spot Index lost 0.1%The euro traded at $1.0030, up 0.2%The Japanese yen was at 138.58 per dollar, up 0.2%The offshore yuan was at 6.9207 per dollar

BondsThe yield on 10-year Treasuries was little changed at 3.10%Australia’s 10-year yield fell one basis point to 3.59%

CommoditiesWest Texas Intermediate crude was at $92.18 a barrel, up 0.6%Gold was at $1,723.69 an ounce